Find Warehouse Space in Europe: Complete 2025 Guide

You're wasting more than 20 hours every month searching for warehouse space. You know it. Your spreadsheets prove it.

You visit a UK property portal. Find three facilities. Copy the details to Excel. Then switch to a German site. Different interface. Different units. Different contact forms. Repeat for France. Netherlands. Poland. By the time you've checked all nine countries, half the properties are already gone.

This isn't just inefficient. It's costing you competitive advantage. While you're manually copying data, your competitors are touring facilities and negotiating terms.

The fragmented nature of European industrial property search creates a fundamental problem. Each country operates its own property portals. Each uses different measurement systems. Each has unique terminology. You're not searching for warehouse space—you're piecing together a jigsaw puzzle across nine languages and nine property systems.

But here's what most logistics managers don't realize: you can save 88% of this time. Not by working harder, but by using specialized tools designed specifically for industrial property search across Europe.

This guide shows you exactly how to find warehouse space efficiently across the UK, Germany, France, Netherlands, Poland, Italy, Spain, Romania, and Czech Republic. You'll learn the 7-step process that reduces search time from 20+ hours to under 2 hours. You'll discover how to build supply chain routes that reveal optimal hub locations. And you'll master automation techniques that alert you to new properties the moment they match your requirements.

Traditional warehouse search wastes 20+ hours per month across fragmented property portals.

What is European Warehouse Property Search?

European warehouse property search is the process of identifying, evaluating, and securing industrial facilities across multiple European countries for logistics, distribution, manufacturing, or storage operations. Unlike residential or general commercial property search, warehouse search requires specialized filters including ceiling height (typically 8-15 meters), floor loading capacity (5-10 tonnes per square meter), loading dock configurations, and multi-modal transport access.

The complexity stems from Europe's fragmented property markets. Each country maintains separate listing platforms with different search interfaces, measurement units, and terminology. A 10,000m² facility with 12-meter ceiling height and 20 loading docks might be listed as "100,000 square feet with 40-foot clear height and 20 dock doors" on UK sites, while using metric measurements on continental European platforms.

Specialized search matters because generic property portals lack the filters industrial property professionals need. You can't search by floor loading capacity or rail siding access on residential-focused platforms. You need tools designed specifically for warehouse and logistics facility search.

The Traditional Search Problem

The average logistics manager spends 22 hours per month searching for warehouse space when expanding across Europe. Let's break down where this time disappears.

Fragmented property portals force you to visit separate websites for each country. Rightmove serves the UK. ImmobilienScout24 covers Germany. SeLoger focuses on France. Each platform has different search filters, display formats, and contact procedures. You're essentially learning nine different property search systems simultaneously.

This fragmentation creates duplicate work. You define your requirements nine separate times. You contact agents through nine different forms. You track properties across nine spreadsheets. Every country becomes its own time-consuming project.

Manual data collection compounds the inefficiency. You copy ceiling heights, loading dock counts, and floor specifications into Excel. You convert square feet to square meters. You translate property descriptions. You screenshot location maps. What should take 30 seconds per property stretches to 5-10 minutes.

One pharmaceutical logistics director told us she maintains three separate Excel files: one for each country cluster (UK/Ireland, Western Europe, Eastern Europe). Each file has 50+ rows of properties with 15+ columns of specifications. Updating this takes 6 hours per week. That's 312 hours per year just maintaining spreadsheets.

Lost opportunities hurt even more than wasted time. Properties move fast in tight European industrial markets, especially in logistics hubs like Venlo, Frankfurt, and the UK's golden triangle. Vacancy rates below 3% mean desirable facilities lease within days of listing.

By the time you've manually checked all nine countries, compiled your data, and scheduled viewings, the best properties are gone. You're always seeing second-tier options because first-tier facilities never make it to your shortlist before being leased.

The cost of inefficiency extends beyond hours. Every week of search delay costs money. Your existing facility might be at capacity, forcing you to turn away business or pay premium rates for overflow storage. Or you're paying penalty rates on short-term leases because you haven't secured a long-term facility.

Calculate it: If you're paying £5,000/month premium on temporary warehouse space, and traditional search takes 3 months versus 3 weeks with specialized tools, that's £25,000 in unnecessary costs. For a single search cycle.

Multiply that across multiple facility searches per year, and traditional search methods cost six figures in both time and opportunity cost.

Modern warehouse search platforms eliminate 88% of manual work through specialized filters and automation.

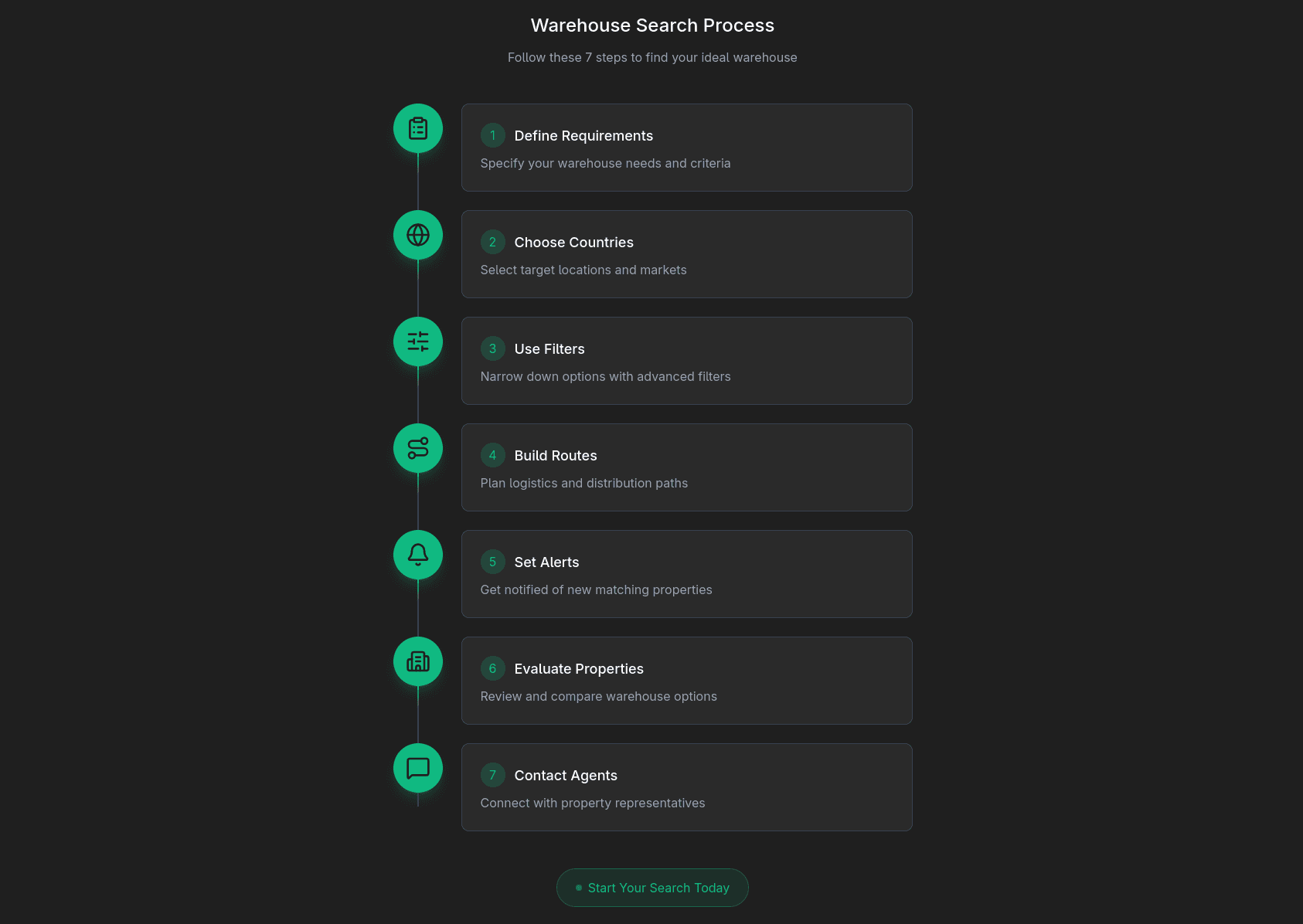

The 7-Step Process to Find Warehouse Space Efficiently

This is the methodology that reduces search time from 20+ hours to under 2 hours. Follow it exactly.

Step 1: Define Your Requirements

Start with a specifications checklist. Don't search blindly and figure out requirements later. Define exactly what you need before opening any property platform.

Physical specifications:

- Floor area (minimum and maximum in square meters)

- Ceiling height (clear height to underside of beams)

- Floor loading capacity (tonnes per square meter)

- Loading dock count (number required, dock levelers needed?)

- Office space percentage (typically 5-10% of total area)

- Yard space for trailer parking (trailers × 15m per unit)

Location requirements:

- Countries (which of the 9 European markets?)

- Motorway access (within 15 minutes of major route?)

- Port proximity (if handling imports/exports)

- Airport access (for air freight operations)

- Labor market (minimum population within 30-minute drive)

Operational requirements:

- Power supply (three-phase capacity in kVA)

- Temperature control (ambient, chilled, frozen zones?)

- Fire suppression (ESFR sprinklers required?)

- Security features (fencing, CCTV, security personnel)

- Expansion potential (adjacent land available?)

Commercial terms:

- Lease vs purchase preference

- Lease duration (3/5/10 years)

- Budget range (per square meter annually)

- Availability timing (immediate vs 6-month lead time)

Create a one-page specification sheet. Share it with your team. Get agreement before searching. This prevents scope creep where different stakeholders keep adding requirements mid-search.

Step 2: Choose Your Target Countries and Regions

Don't search all nine countries randomly. Strategic country selection saves massive time.

For UK market access: Focus on the golden triangle (Midlands region bounded by Birmingham, Northampton, and Doncaster). This area offers the best access to the entire UK population within 4-hour trucking radius.

For Western European distribution: Prioritize Netherlands (Rotterdam/Venlo corridor) and Belgium (Antwerp region). These locations provide optimal access to Germany, France, Benelux, and UK markets.

For Central European manufacturing: Target Poland (Warsaw, Poznań) and Czech Republic (Prague, Brno). Lower costs with excellent access to German manufacturing clusters.

For Southern European coverage: Consider Northern Italy (Milan/Verona) or Barcelona, Spain. These hubs serve Mediterranean markets with port access.

For emerging market expansion: Romania (Bucharest) offers EU access with competitive costs and growing consumer markets.

Most companies need 2-3 strategic hubs to cover all European markets efficiently. Start by identifying which countries serve your primary customer concentrations.

Use IndiFind's route planning tool to visualize coverage from different hub locations. This shows you exactly which facility locations provide optimal delivery radius to your customers.

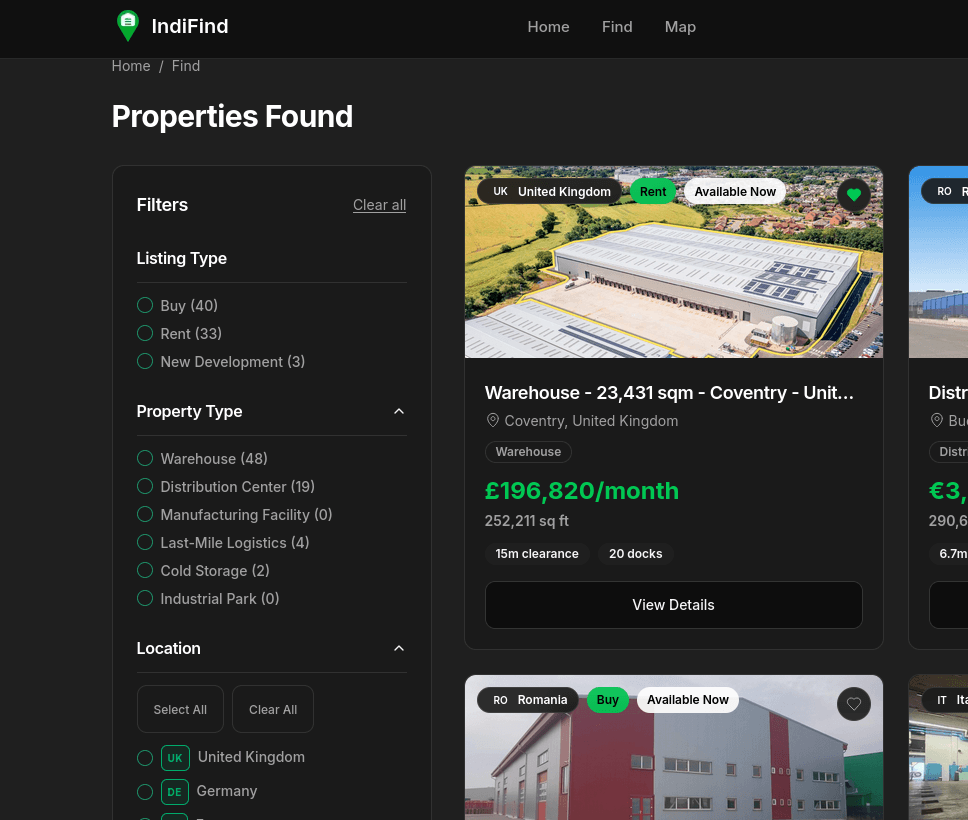

Step 3: Use Specialized Search Filters

Generic property portals force you to scroll through pages of irrelevant results. Specialized industrial property search lets you filter precisely.

Essential filters for warehouse search:

Ceiling height filter: Set minimum height in meters. Modern logistics requires 10-12m for high-bay racking. E-commerce fulfillment needs 12-15m for automated storage systems. Manufacturing might only need 8-10m.

Floor loading filter: Specify minimum tonnes per square meter. Heavy industrial goods require 8-10 tonnes/m². Standard pallet racking needs 5-7 tonnes/m². Light goods can work with 3-5 tonnes/m².

Loading dock filter: Set minimum dock count. Calculate one dock per 2,000-3,000m² of warehouse space for standard distribution operations. E-commerce fulfillment needs higher density (one per 1,500m²).

Transport access filters: Distance to motorway junctions, ports, airports, rail sidings. Set maximum distances based on your operations (typically 5km to motorway, 30km to port).

Power capacity filter: Minimum electrical supply in kVA. Automated warehouses need 1,000+ kVA. Standard operations work with 400-800 kVA.

Filter combinations are powerful. Try: "Germany + 10,000-15,000m² + 12m ceiling + 20+ docks + within 10km of motorway." This returns only facilities that exactly match your needs, not hundreds of irrelevant properties.

On IndiFind, you can save filter combinations as "preferences" and reuse them instantly. No re-entering specifications for every search.

Step 4: Build Supply Chain Routes

This is where warehouse search becomes strategic, not just tactical.

Plot your existing customer locations on a map. Add your supplier locations. Now overlay potential warehouse locations. Which facilities create the most efficient distribution network?

IndiFind's route planning feature lets you visualize this. Add potential warehouse locations to a map. Draw delivery routes to customer clusters. See coverage gaps immediately.

Example: A 3PL serving UK and Western Europe might identify three strategic hubs:

- UK hub: Birmingham area (4-hour coverage of entire UK)

- Benelux hub: Venlo, Netherlands (overnight coverage of Netherlands, Belgium, Western Germany, Northern France)

- Central hub: Frankfurt, Germany (overnight coverage of Central Germany, Switzerland, Austria)

These three locations provide next-day delivery to 85% of European GDP with optimal transport costs.

Compare this to randomly selecting warehouses in London, Paris, and Berlin. Those locations create overlapping coverage in some areas and gaps in others. Route planning reveals the difference.

Strategic route planning also identifies whether you need warehouses at all. Could you consolidate into two larger hubs instead of three smaller ones? The visualization makes this obvious.

Learn more in our complete Supply Chain Route Planning Europe Guide.

Step 5: Set Up Automated Alerts

Manual search means checking property sites daily. Automated alerts mean properties find you.

Configure alerts based on your saved preferences. When a warehouse matching your specifications gets listed, you receive immediate notification. No daily portal checking required.

Smart alert configuration:

- Set alerts for each strategic location separately

- Use slightly wider parameters than your ideal (e.g., 9-16m ceiling instead of exactly 12m)

- Receive daily digests rather than real-time emails (prevents inbox overload)

- Configure alerts for 3-month lead time properties, not just immediate availability

The key is balance. Too narrow, and you miss opportunities. Too broad, and you get irrelevant alerts. Start narrow, then expand if you're missing opportunities.

IndiFind sends alerts within 1 hour of new property listings. In tight markets where properties lease within days, being first to respond matters.

Step 6: Evaluate and Compare Properties

You've filtered to a shortlist of 5-10 properties per location. Now evaluate systematically.

Location scoring framework:

Transport connectivity (weight: 30%): Motorway distance, port access, airport proximity, rail siding availability. Score 1-10.

Labor market (weight: 20%): Population within 30-min drive, unemployment rate, average warehouse wages, competing employers. Score 1-10.

Cost competitiveness (weight: 25%): Rent per m² vs market average, service charges, business rates, total occupancy cost. Score 1-10.

Physical suitability (weight: 15%): Ceiling height adequacy, dock configuration, office space, yard area, expansion potential. Score 1-10.

Risk factors (weight: 10%): Flood risk, planning constraints, infrastructure development, market stability. Score 1-10.

Calculate weighted average. Properties scoring 8+ warrant site visits. Properties scoring 6-7.9 are backup options. Below 6, eliminate from consideration.

This systematic approach prevents emotional decisions. You're not choosing the newest-looking warehouse or the one with the friendliest agent. You're selecting based on objective operational criteria.

Create comparison spreadsheets once, then reuse the template for every property search. IndiFind's comparison tool does this automatically, letting you score properties side-by-side.

Step 7: Contact Agents and Negotiate

You've identified your top 3 properties per location. Time to move fast.

First contact template:

"We require [X]m² warehouse space in [location] with [key specs]. Your property at [address] appears to match. We can view within 48 hours. Please confirm availability and provide: (1) detailed specification sheet, (2) floor plans, (3) lease terms/pricing, (4) availability date."

This shows you're serious and qualified. Agents prioritize serious inquiries over tire-kickers.

Property viewings: Schedule back-to-back viewings in the same day. View all 3 properties in one trip. This makes comparison easier and negotiation stronger ("We're viewing three facilities today; we'll make a decision by Friday").

Negotiation leverage: Tight industrial property markets give landlords power, but you still have leverage:

- Long lease commitment (10 years vs 5 years)

- Minimal landlord fit-out required

- Strong tenant covenant (financial stability)

- Quick decision timeline

- Flexibility on start date

Typical rent-free periods in industrial property: 6-12 months for new builds, 3-6 months for second-hand space, 1-3 months for short-term lets. Negotiate based on market conditions and your lease length.

The systematic seven-step process reduces warehouse search time from 20+ hours to under 2 hours.

How to Evaluate Industrial Properties Across Europe

Evaluation separates good facilities from great ones. Here's the framework.

Location analysis goes beyond "near a motorway." You need granular assessment:

Motorway junction quality: Not all junctions are equal. A junction with full interchange (all directions) beats a half-interchange (limited directions). Check HGV restrictions, bridge weight limits, and peak-hour congestion patterns.

Last-mile delivery radius: For urban distribution centers, map 30-minute, 60-minute, and 90-minute drive time zones. Use actual traffic patterns, not straight-line distance. A facility 20km from a city center might have better access than one 10km away if it's on the correct side for traffic flow.

Labor catchment analysis: Calculate population within 30-minute commute by car and public transport separately. Check unemployment rates and competing warehouses. A facility in an area with five other large distribution centers will face wage inflation and recruitment challenges.

Future infrastructure: Research planned motorway expansions, rail improvements, and logistics park developments. A facility might look average today but excellent in 3 years when planned infrastructure completes.

Physical specification assessment requires on-site verification. Don't trust listing specs blindly.

Ceiling height measurement: Measure clear height to the underside of beams, not to the roof peak. Check for HVAC ductwork, fire suppression systems, and lighting that reduce usable height. A listed "12m ceiling" might only offer 10.5m clear height after obstructions.

Floor loading reality: Request structural engineer reports. Check if the quoted capacity is uniform across the entire floor or only in certain zones. Older warehouses often have reinforced areas for racking but lower capacity in aisles.

Loading dock configuration: Count docks and measure dock-to-dock spacing. Check dock leveler types (mechanical vs hydraulic). Verify door sizes accommodate your trailer types. European trailers are typically 2.4m wide × 2.7m high; UK curtain-siders might be different.

Column spacing: Measure bay sizes (distance between columns). Modern warehouses offer 12m × 24m grids. Older facilities might have 6m × 12m grids that limit racking configurations. This massively affects storage density.

Cost comparison requires total cost of occupancy calculation, not just headline rent.

Base rent is only 40-60% of total cost. Add:

- Service charges (building maintenance, common areas)

- Business rates or property tax (varies by country and region)

- Insurance (typically 0.1-0.3% of property value annually)

- Utilities (electricity for lighting, heating, cooling)

- Security costs (if not included in service charge)

- Maintenance reserves (for tenant obligations)

Calculate cost per square meter annually including all these factors. A facility at €60/m² rent with €10/m² service charge and moderate business rates might cost the same as one at €55/m² rent with €20/m² service charge and high business rates.

Risk evaluation prevents expensive mistakes:

Flood risk: Check local flood maps. Properties in 1-in-100-year flood zones require expensive insurance and might be uninsurable for certain goods. Even slight flood risk increases insurance premiums by 30-50%.

Planning constraints: Verify the facility has proper industrial use planning permission. Check for restrictions on hours of operation, HGV movements, or noise levels. Some warehouses in mixed-use areas face operational restrictions that aren't immediately obvious.

Environmental issues: Request Phase 1 environmental reports. Former industrial sites might have soil contamination requiring expensive remediation. This becomes your liability under European environmental law.

Structural condition: For second-hand facilities, get structural surveys. Roof repairs, floor slab replacement, and dock refurbishment can cost €50-150/m². A cheap facility needing €500,000 in repairs isn't cheap anymore.

Link to detailed guides on specific evaluation topics:

- Warehouse Ceiling Height Requirements: Complete Guide

- Loading Dock Specifications for Modern Warehouses

- Warehouse Floor Loading Capacity: What You Need

- Industrial Property Due Diligence Checklist

Supply Chain Route Planning for Multi-Country Searches

Single-facility search is tactical. Multi-facility network design is strategic.

Why route planning matters: Your warehouse locations determine your entire logistics cost structure. The wrong locations add 15-30% to transport costs. The right locations create competitive advantage through faster delivery at lower cost.

Strategic hub identification starts with customer demand mapping. Plot your customers (or market opportunity) by location and volume. Where are your largest concentrations? Where's your growth potential?

Example: An e-commerce company serving UK and Western Europe has three customer concentration zones:

- 40% of orders from UK and Ireland

- 35% from Germany, Netherlands, Belgium

- 25% from France, Spain, Italy

A single warehouse can't serve all zones cost-effectively. Two warehouses might work: UK hub for UK/Ireland, Benelux hub for continental Europe. But three might be optimal: UK, Benelux, and Southern Europe.

Route planning tools visualize this. Plot potential hub locations. Draw delivery radius circles. Calculate transport costs from each hub to customer zones. The optimal network becomes clear.

Multi-modal transport considerations expand your options beyond road freight:

Rail-served warehouses reduce costs for long-haul routes. A facility in Frankfurt with rail siding can move containers to/from Rotterdam port at 30-40% less cost than road transport. But rail requires minimum volumes (full container loads, regular schedules).

Port proximity matters for import/export operations. A warehouse within 30 minutes of Rotterdam, Antwerp, or Hamburg reduces drayage costs and transit times. You can operate just-in-time from port rather than holding large buffer inventory.

Airport access is critical for air freight operations (express delivery, perishables, high-value goods). Facilities within 15km of major cargo airports command premium rents but enable next-flight-out service levels.

Calculate mode-specific costs:

- Road: €0.80-1.20 per kilometer for full truckload

- Rail: €0.25-0.45 per kilometer for container loads

- Short sea shipping: €0.15-0.30 per kilometer for pallet loads

Route planning identifies which transport modes suit which legs of your network.

This topic deserves deep exploration. Read our complete Supply Chain Route Planning: The Complete European Guide for the full methodology, corridor analysis, and hub selection frameworks.

Strategic hub placement optimizes delivery coverage while minimizing transport costs across European markets.

Country-by-Country Search Strategies

Each European market has unique characteristics. Adapt your search approach accordingly.

United Kingdom: Focus on the golden triangle (Midlands). This 50-mile radius around Coventry provides 4-hour delivery to 90% of UK population. Prime rents: £65-120/m² annually. Vacancy rates under 2%. Brexit created short-term disruption but didn't fundamentally change logistics geography. Watch for increased demand near ports (Dover, Felixstowe, Southampton) for EU import consolidation.

Germany: Target major logistics hubs: Hamburg (northern gateway, Scandinavian access), Frankfurt (central location, air cargo), Ruhr region (manufacturing heartland), Rhine corridor (north-south artery). Prime rents: €45-95/m². Germany offers the most developed logistics infrastructure in Europe but faces labor shortages in some regions. Ceiling heights tend to be conservative (10-12m) compared to newer markets.

France: Paris region (Île-de-France) dominates with 30% of French logistics space. Lyon serves as southern gateway. Marseille offers Mediterranean port access. Prime rents: €40-85/m². French market is recovering from years of undersupply, with speculative development increasing. Labor regulations are strict; factor in higher employment costs.

Netherlands: The logistics superpower despite small size. Rotterdam is Europe's largest port. Venlo (near German border) is the e-commerce capital of Europe. Prime rents: €55-90/m². Vacancy rates below 1.5%. Land scarcity drives vertical development (taller warehouses, mezzanine offices). Environmental regulations are strict but well-defined.

Poland: The manufacturing reshoring destination. Warsaw serves as central European hub. Poznań offers western Poland access. Upper Silesia (Katowice region) provides industrial manufacturing base. Prime rents: €30-60/m² (significant cost advantage). Modern facilities match Western European specifications. Labor costs are 40-60% lower than Germany but rising fast.

Italy: Northern Italy dominates: Milan (consumer market), Verona (logistics crossroads), Bologna (distribution hub). Prime rents: €50-85/m². Southern Italy offers lower costs but infrastructure challenges. Bureaucracy can slow transactions; factor in longer lead times for permits and approvals.

Spain: Barcelona and Madrid are dual hubs (coastal vs inland). Valencia serves Mediterranean distribution. Prime rents: €40-75/m². Recovery from financial crisis drove significant warehouse development. Modern facilities are high quality. Language barrier less significant in logistics sector than other industries.

Romania: Bucharest is the emerging market opportunity. Modern facilities appearing in logistics parks around the capital. Prime rents: €35-55/m². EU membership provides regulatory alignment. Workforce availability good but skills vary. Infrastructure improving but still behind Western Europe.

Czech Republic: Prague serves as Central European gateway. Brno offers southern Czech access. Prime rents: €35-65/m². Strong automotive logistics cluster. Modern facilities built to Western standards. Strategic location between Germany and Eastern Europe creates natural distribution hub role.

Country-specific guides provide deeper market insights:

- How to Find Warehouse Space in the UK (2025 Guide)

- How to Find Warehouse Space in Germany (2025 Guide)

- How to Find Warehouse Space in France (2025 Guide)

- Netherlands, Poland, Italy, Spain, Romania, Czech Republic guides

Advanced Search Techniques

Move beyond basic filtering. These techniques find properties others miss.

Filter combination power: Don't use single filters. Combine them intelligently.

Try: "Netherlands + 8,000-12,000m² + 11m+ ceiling + 15+ docks + <5km motorway + <30km Rotterdam port." This hyper-specific search might return only 2-3 properties, but they're exactly what you need. No scrolling through hundreds of irrelevant results.

Expand gradually if results are too limited. First relax ceiling height to 10m+. Then expand area range to 7,000-14,000m². Then increase motorway distance to <10km. Each expansion brings more results; stop when you have 5-10 qualified options.

Preference-based automation saves filter recreation. On IndiFind, save filter combinations as named preferences: "UK Midlands Standard," "Benelux E-commerce," "Poland Manufacturing." Apply entire filter sets with one click.

Update preferences as requirements evolve. When you need to add rail siding access across all searches, update the master preference rather than recreating filters every time.

Alert configuration strategies maximize coverage without inbox overload:

Multiple location alerts: Set separate alerts for each strategic location. Don't combine "UK OR Germany OR Netherlands" into one alert. Create three separate alerts. This makes filtering easier and prevents missing location-specific opportunities.

Tiered alert urgency: Set tight filters for "urgent" alerts (email immediately) and looser filters for "monitoring" alerts (weekly digest). Urgent = exact matches; monitoring = adjacent opportunities.

Lead time alerts: Properties listing 3-6 months before availability are less competitive. Set alerts for future-dated availability, not just immediate occupation. You'll see opportunities others miss while they focus on "available now."

Time-saving shortcuts compound efficiency:

Saved search URLs: Bookmark your most frequent searches with filters pre-applied. One click returns your standard "UK golden triangle, 10,000m², 12m ceiling" search.

Comparison templates: Create spreadsheet templates for property comparison with your standard scoring criteria pre-loaded. Copy-paste property details rather than rebuilding comparison matrices each time.

Agent relationship clustering: Identify the top 3-5 industrial agents in each market. Build relationships. Brief them once on your requirements. They'll proactively send opportunities before they hit public listings.

Technical how-to guides expand these techniques:

- Warehouse Search Automation (Alerts & Preferences)

- How to Calculate Warehouse Space Requirements

- Comparing Warehouse Properties (Apples-to-Apples)

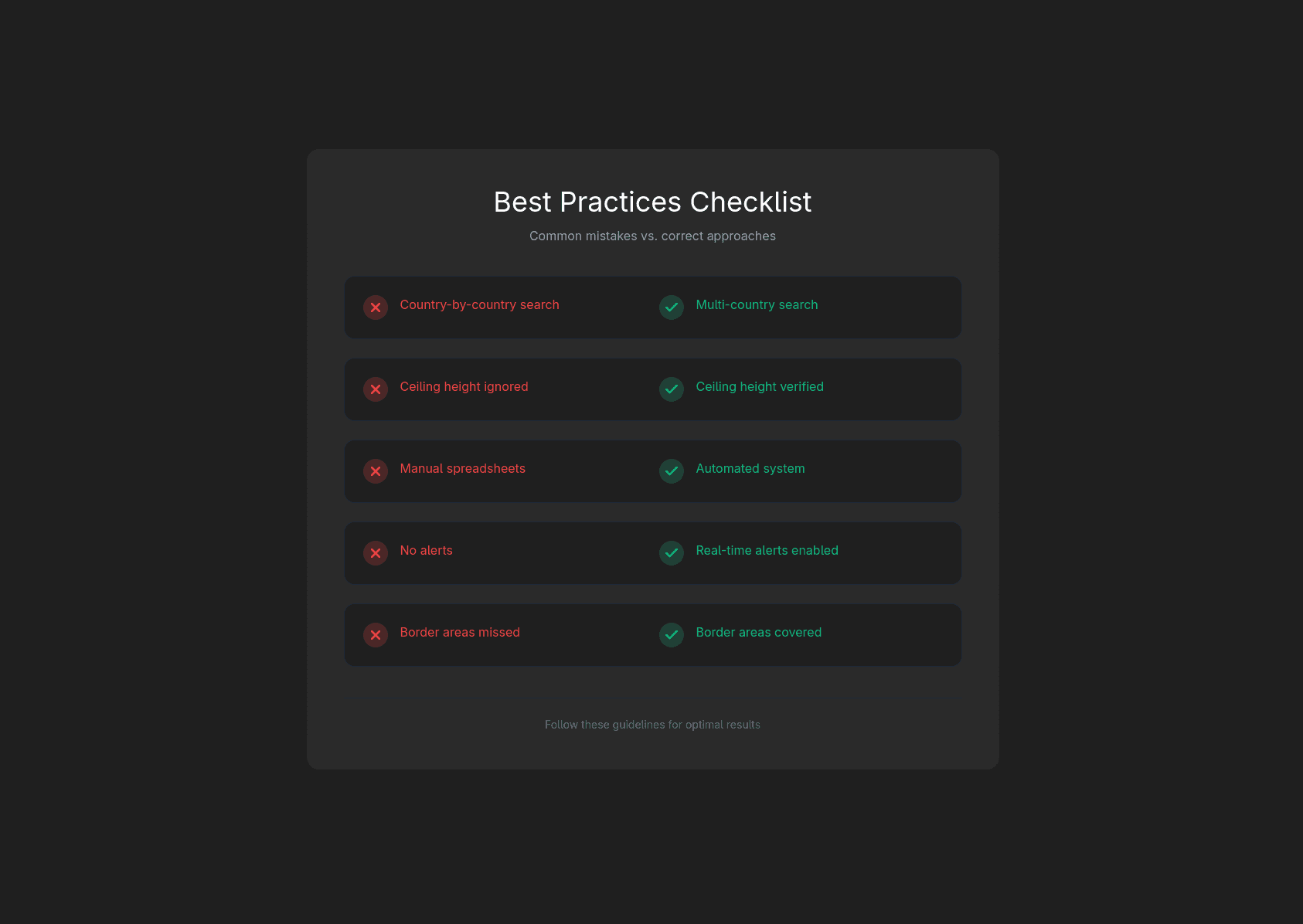

Common Mistakes and How to Avoid Them

Learn from others' expensive errors.

Mistake 1: Searching one country at a time. Logistics doesn't respect national borders. Your customers are in six countries. Why would you search sequentially rather than simultaneously?

Sequential search means you find the "best UK option" and "best German option" independently. But maybe the best overall solution is two Netherlands facilities instead of one UK and one German facility. You'll never discover this searching sequentially.

Fix: Search all relevant countries simultaneously. Use multi-country filtering. Compare properties across borders, not within borders. The optimal facility might be in a country you hadn't initially considered.

Mistake 2: Ignoring ceiling height early. Ceiling height is the one specification you absolutely cannot change without massive cost. Floor loading can be reinforced. Loading docks can be added. Office space can be built. But ceiling height is structural and permanent.

Many searchers filter by location and size, then realize later that 75% of their results have 8m ceilings when they need 12m. They wasted hours evaluating properties that never qualified.

Fix: Make ceiling height your second filter (after location). This eliminates more irrelevant properties than any other filter. For modern logistics operations, set minimum 10m. For high-bay racking or automation, set 12m+.

Mistake 3: Manual spreadsheet tracking. Copying property details into Excel is 1990s methodology in a 2025 market.

Manual spreadsheets introduce errors. You mistype a ceiling height. You convert square feet to square meters incorrectly. You update the Coventry facility details but paste them into the Birmingham row. These errors corrupt your decision-making.

Worse, manual tracking means you evaluate properties one at a time as you find them, not in systematic batches. You can't easily compare five facilities side-by-side when data is scattered across spreadsheet rows entered over three weeks.

Fix: Use platform comparison tools that let you save properties and compare them in standardized formats. No manual data entry. No conversion errors. Direct side-by-side comparison.

Mistake 4: Not setting up alerts. Active daily search means you're checking property portals even when nothing new has listed. This wastes 15 minutes per day (75 minutes per week, 65 hours per year) checking for updates that aren't there.

Meanwhile, properties that do list while you're not checking might lease before you see them. You get the worst of both worlds: wasted time checking plus missed opportunities.

Fix: Configure automated alerts once. Check your email instead of checking property portals. You save 60+ hours annually and never miss a new listing.

Mistake 5: Overlooking cross-border logistics. A facility 5km from a border might serve two countries efficiently. But many searchers only search within national boundaries and miss these opportunities.

Example: Venlo, Netherlands sits on the German border. A warehouse here serves both Dutch and German markets. You're essentially getting dual-country coverage from one location. But if you search "Netherlands" and "Germany" separately without considering border areas, you might miss this entirely.

Fix: When searching border regions, use radius searches centered on the border, not country filters. Or search multiple countries simultaneously and sort by distance from a border crossing point.

Avoiding these five common mistakes saves 15-20 hours per search cycle and prevents missing optimal properties.

The Future of Industrial Property Search

The warehouse search process is evolving rapidly. Here's what's coming.

AI-powered recommendations will suggest properties you haven't searched for based on your patterns. If you've viewed 10 facilities in the UK golden triangle averaging 12,000m² with 12m ceiling height, the system learns your preferences. When a property matching this profile lists in Germany's Ruhr region—a location you hadn't considered—you get proactive recommendations.

Machine learning identifies patterns humans miss. It might notice that every property you shortlisted has rail siding access, even though you never explicitly filtered for this. Future searches automatically prioritize rail-served facilities.

Predictive availability uses data signals to forecast which facilities will become available before they're officially listed. Properties often show pre-listing signals: lease expiry dates from public records, tenant company announcements, planning applications for new facilities (suggesting relocation).

By analyzing these signals, platforms can alert you to likely vacancies 3-6 months before public listing. In tight markets where properties lease within days of listing, 3-6 months advance notice creates massive competitive advantage.

Virtual reality tours are already emerging for high-end commercial property. Within 2-3 years, they'll be standard for industrial facilities. Put on VR headset, walk through a warehouse in Hamburg from your office in Madrid. Measure ceiling heights virtually. Test sight lines from different positions.

This reduces travel costs and speeds initial screening. Instead of flying to view 5 facilities and finding 3 unsuitable, virtual tour all 5 and fly only to view the 2 that pass virtual screening.

Blockchain for transactions will streamline the lease agreement process. Smart contracts automatically execute when conditions are met. Property transfers happen through verified digital signatures rather than multi-month paper processes.

This matters most in cross-border transactions where different legal systems create friction. Blockchain provides a trusted intermediary that all parties accept, reducing transaction time from months to weeks.

The common thread across all these innovations: automation replacing manual work. The 88% time savings available today will increase to 95%+ savings in the future. Search will shift from "finding properties" to "evaluating AI-curated options."

Conclusion

Finding warehouse space across Europe doesn't have to consume 20+ hours per month. The systematic approach outlined here reduces search time to under 2 hours while improving result quality.

The seven-step process works:

- Define requirements precisely before searching

- Choose strategic target countries based on network optimization

- Use specialized filters to eliminate irrelevant results

- Build supply chain routes to identify optimal hub locations

- Set automated alerts to receive relevant properties continuously

- Evaluate properties systematically using objective scoring

- Contact agents professionally and negotiate from strength

The efficiency gains are real: 88% time savings means recovering 17+ hours per month. That's 200+ hours annually. Use this time for strategic work instead of manual property portal checking.

The competitive advantage compounds: Find properties faster. Secure better facilities. Negotiate from stronger positions. Optimize your logistics network instead of settling for available options.

Start searching smarter today. Create your free IndiFind account and access 10,000+ industrial properties across 9 European countries. Set your preferences once. Build your supply chain routes. Receive automated alerts. Find warehouse space 88% faster.

Your first search takes 2 hours instead of 20. Your second search takes 90 minutes. By your fifth search, you're completing in under 60 minutes what previously consumed entire days.

Start your warehouse search now or explore our route planning tools to visualize optimal hub locations across Europe.

Free forever for property seekers. No credit card required. No hidden fees. Just professional industrial property search the way it should be.

Tags

Read Next

Warehouse Location Selection Strategy for Europe

A practical playbook for selecting industrial warehouse locations across Europe based on network design, not guesswork.

How to Find Warehouse Properties in Europe

Learn how to efficiently find warehouse properties across Europe using supply chain routes, automated alerts, and strategic search techniques.

Warehouse Industrial for Rent: Complete European Guide

A complete, data-driven guide to renting industrial warehouse space in Europe: specifications, costs, lease terms, location strategy, and the exact process to secure the right facility with less risk and less wasted time.